How it works

Didit's Reusable KYC allows users to verify their identity once and securely reuse that verification across multiple applications. This feature dramatically reduces onboarding time while maintaining high security standards and regulatory compliance.

1. Initial Verification

- Complete standard KYC process (document verification + facial recognition)

- Verification complies with eIDAS2 and relevant regulations

- Data is encrypted and stored in user's Didit ID

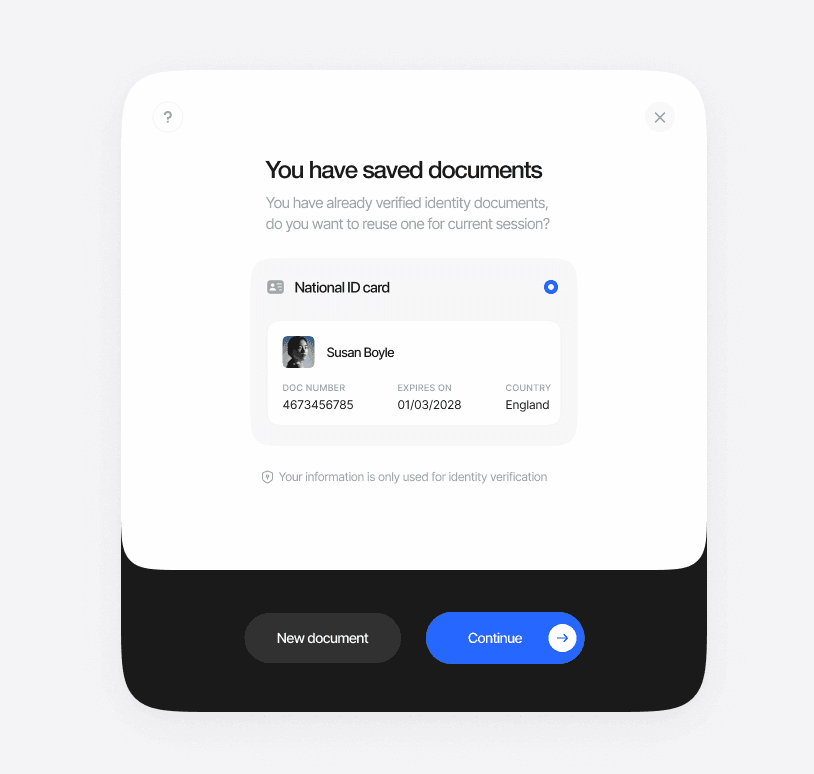

2. Reuse Process

- User encounters new Didit-integrated application

- Selects option to reuse existing KYC

- Completes quick facial recognition check

- Consents to share specific verification data

- New application receives verified KYC information instantly

Key Benefits

| For Users | For Businesses | For Compliance |

|---|---|---|

| ✓ Verify once, use anywhere | ✓ Faster user onboarding | ✓ Maintains regulatory standards |

| ✓ Control over data sharing | ✓ Reduced drop-off rates | ✓ Complete audit trail |

| ✓ Seconds instead of minutes | ✓ Higher conversion rates | ✓ Cross-jurisdiction support |

Security & Compliance

-

Advanced Security

- End-to-end encryption

- Biometric verification for each reuse

- Protection against account takeover

-

Regulatory Compliance

- eIDAS2 compliant

- Supports AML/KYC requirements

- Cross-border verification support

Real World Example: A user verifies their identity with FinTech App A. Later, when signing up for Gaming Platform B, they can reuse their verification by:

- Selecting "Use Existing Verification"

- Completing a quick facial check

- Choosing which data to share

- Getting instant access

The Future of Verification

Didit's Reusable KYC solution sets a new standard in online identity verification by making the process more efficient, secure, and user-friendly. Users own their verification data and can share it with total consent, enhancing privacy and control. Verification times are reduced tenfold, revolutionizing the way identities are verified online.

The reusable KYC is always available to users who have completed the initial verification process on the document verification page. Users can choose to reuse their KYC information when prompted during the verification process of a new application, or they can perform a new KYC check if they prefer.